New Hampshire offers residents and businesses clean energy incentives to install solar panels and invest in clean energy vehicles.

In combination with federal tax credits for green energy, the cost of any new equipment installed can qualify.**

TAX INCENTIVE NOTICE*

**Fraud Alert**

US Green Energy

Click Here to Sign Up for Free Solar Panel Installation

| Schedule | Acceptance Date | Last Day To Register |

|---|---|---|

| Q1 | Monday January 1, 2024 | March 30, 2024 |

| Q2 | Monday April 1, 2024 | June 30, 2024 |

| Q3 | Monday July 1, 2024 | September 30, 2024 |

| Q4 | Tuesday October 1, 2024 | December 30, 2024 |

| Q1 (2025) | Wednesday January 1, 2025 | March 30, 2025 |

Energy Efficiency Rebates and Incentives

PLEASE NOTE: Beginning in 2025, the federal tax incentives for solar residential installation will be impacted. See the table below for the dates and amounts currently legislated.

**The Federal tax credit is available every year that new equipment is installed.

New Hampshire Government

Office of the Governor

State House

107 North Main Street

Concord, NH 03301

Phone: (603) 271-2121

Fax: (603) 271-7680

[email protected]

Hours: M-F 8:00am – 4:30pm

Eversource

P.O. Box 330

Manchester, NH 03105-0330

(800) 662-7764

Hours: 8:00am to 6:00pm

New Hampshire Department of Energy

21 South Fruit Street, Suite 10

Concord, NH 03301

(603) 271-3670

[email protected]

Hours: 8:00am to 4:30pm

National Weather Service

1325 East West Highway

Silver Spring, MD 20910

Main: (828) 271-4800

Fax: (828) 271-4876

TTY: (828) 271-4010

Email: [email protected]

Hours: M-F 8:00am-6:00pm

Clean Energy and Vehicle Federal Tax Credits

Business Federal Tax Credits

State Tax Credit and Rebate Schedule

| Year | Credit Percentage | Availability |

|---|---|---|

| 2024-2032 | 30% | Individuals who install equipment during the tax year |

| 2033 | 26% | Individuals who install equipment during the tax year |

| 2034 | 22% | Individuals who install equipment during the tax year |

| Residential Renewable Electrical Generation Rebate | $1,000 max | Residential properties with solar energy systems |

| Solar Property Tax Exemption | Upgraded property value tax is exempt | Applies to residential property using solar energy |

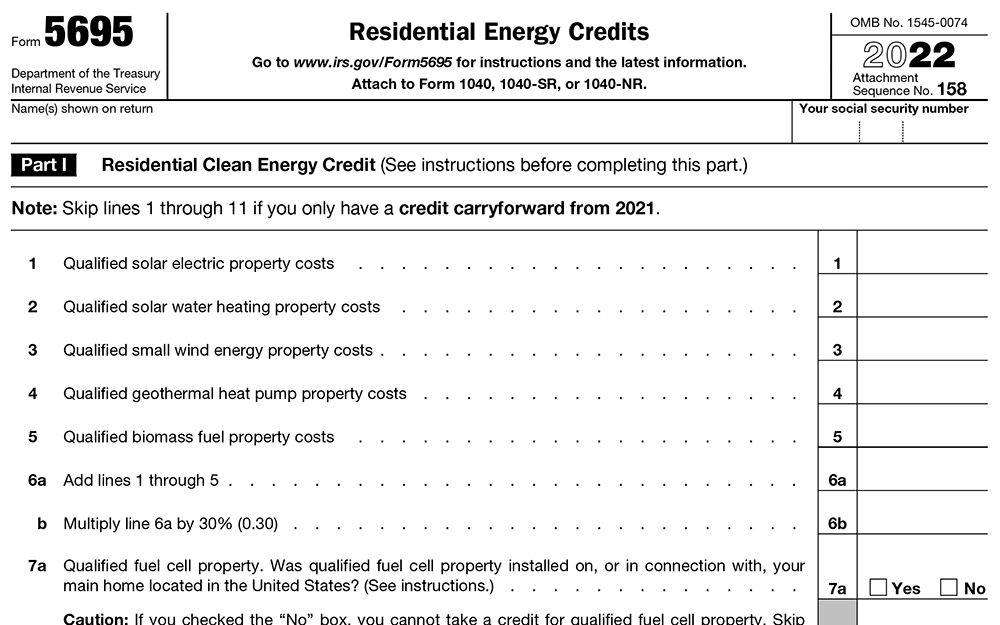

If you have determined that you are eligible for the green energy credit, complete Form 5695 and attach to your federal tax return (Form 1040 or Form 1040NR).

IRS Form 5695

Instructions

Future Due Dates and Basics

Office of Energy Efficiency & Renewable Energy

Forrestal Building

1000 Independence Avenue, SW

Washington, DC 20585

RESIDENTIAL CLEAN ENERGY TAX CREDIT

New Hampshire Clean Energy

Renewable Portfolio Standard

Renewable Energy Fund

Renewable Energy Rebates

Net Metering

Low-Moderate Income Solar Grant Program

Offshore Wind Energy

Power Outage Map

New Hampshire Department of Environmental Services

29 Hazen Drive

Concord, NH 03302-0095

Office Hours:

Monday to Friday

8 AM – 4 PM

Phone: (603) 271-3503

Portsmouth Regional Office

Pease International Tradeport

222 International Drive, Suite 175

Portsmouth, NH 03801

Federal tax credits exist, there’s a statewide solar rebate, net metering opportunities and property tax exemptions, and other renewable energy programs designed to make New Hampshire solar incentives an effective tool for establishing green energy solutions in the state.

Best of all, open enrollment is available to all residents.

Overview of New Hampshire Solar Energy

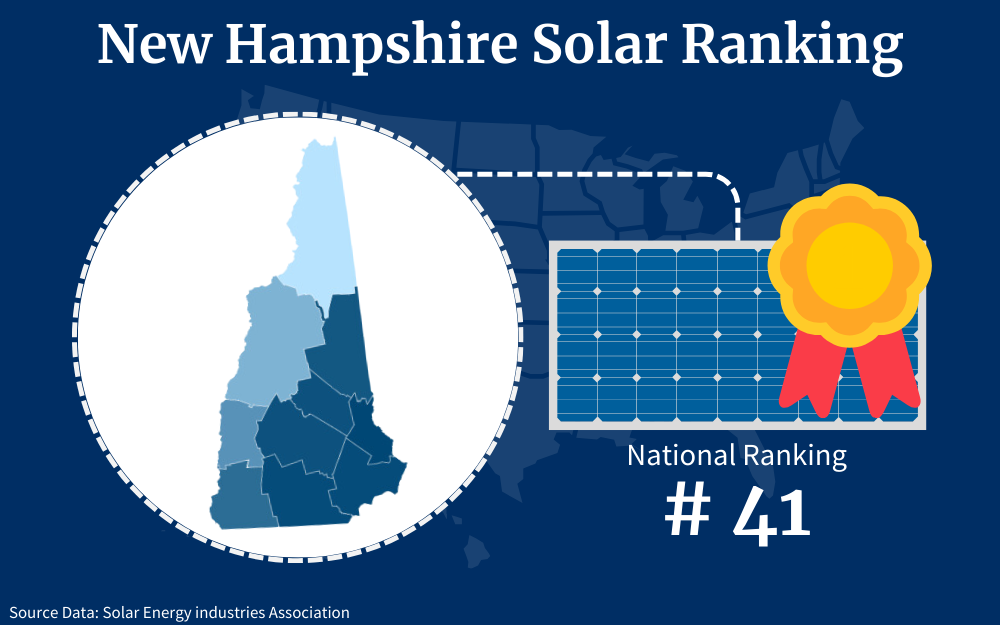

Ranking just 41 in the nation, over 29,500 homes are powered by solar in NH,8 meaning about 1 in 19 households run on solar power according to 2022 census numbers (to calculate, divide the population by average persons per household, which is 2.46, then divide that number by 29,500).22

Solar is still unique in New Hampshire, though it’s growing in popularity due to the fact that solar energy systems can significantly reduce utility costs for residents.

This guide explains the available incentive options in NH, and outlines by how much solar savings can be achieved after residential solar installation, as well as the involved costs, frequently asked questions about solar power, and how you can enroll in these incentives right away.

New Hampshire Solar Incentives

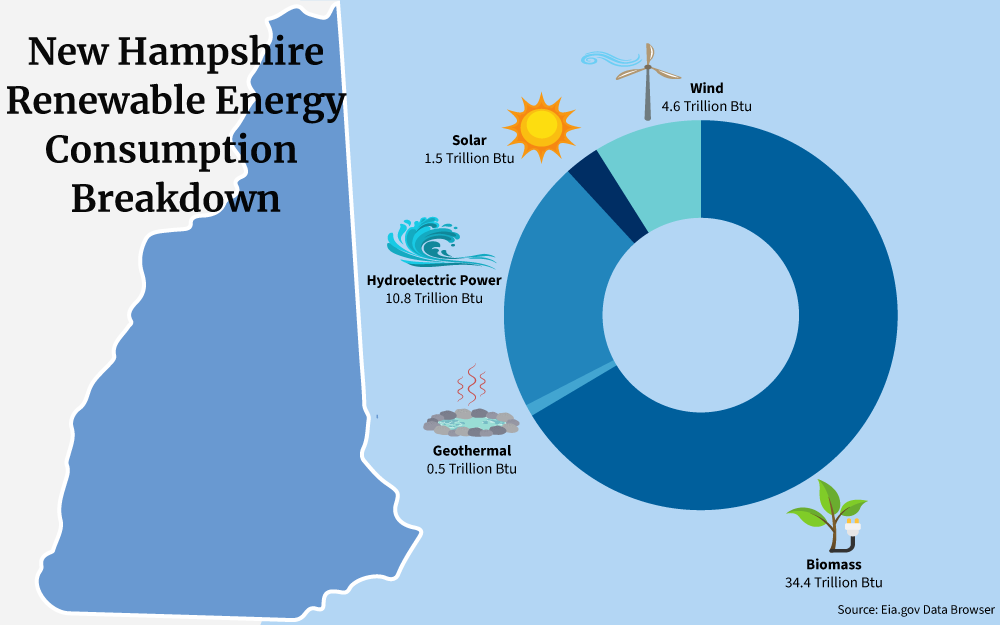

New Hampshire produces 1,491,000 Megawatts of green power or renewable energy a year.3 One reason the state has been able to produce more than a Megawatt of energy per resident has to do with incentives available through the region.

The state offers the following New Hampshire solar incentives, including:

- Statewide Solar Rebates

- Property Tax Exemptions

- Opportunities in Net Metering

- PACE Financing For Commercial Applications

- Localized Incentive Options For New Hampshire Residents

Statewide Solar Rebates

Some rebates for solar aren’t offered throughout the state; they may be offered per county or township, but aren’t statewide. That’s not the case with New Hampshire.

Essentially, every kilowatt (kW) you install gives you the opportunity for a $200 rebate.13 Residents get up to $1,000 knocked-off solar installation (rebates no longer apply for arrays larger than 5 kW).

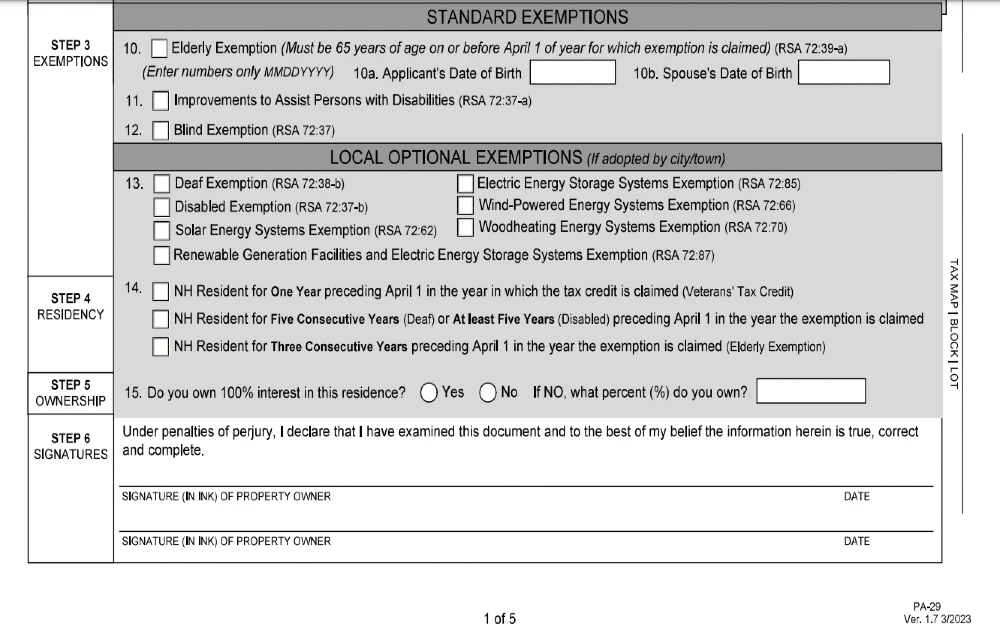

Property Value Enhancement Exemption

You will not be taxed for the additional value a new solar array may bring. If you installed a $20,000 system, a tax assessor would not add that to your taxation responsibility.

You get the added equity without the added tax. Here is the exemption’s precise wording:7 It applies to solar heating, solar electric generation, residential applications, and commercial applications.

Opportunities in Net Metering

There is a net metering mandate in NH for utility companies of a certain size. Liberty Utilities, Unitil, Eversource, and the NHEC (Hew Hampshire Electric Cooperative), all offer this option as a result. Since rates are variable, it’s best to contact the company you work with to explore options.

New England generally has high costs for electrical production.27 So net metering tends to be more beneficial to residents in states like NH.

PACE Financing for Commercial Applications

PACE stands for Property-Assessed Clean Energy.

In NH, commercial and residential PACE options exist. PACE helps commercial and residential persons finance renewable energy installation.

The idea is to substitute a loan payment for a utility bill without a diminution in quality of life, or your productive capability in business terms.

Since each home and business differs, financing will likewise vary. Presently NH PACE is only available to residential or commercial property owners,24 not those involved in a lease. It’s not a good move if your total cost will be less than $2,500 for a given array.

Localized Incentive Options for New Hampshire Residents: Eversource ConnectedSolutions

The Eversource ConnectedSolutions Program is one of many localized NH renewable incentives.

There’s a $750,000 fund available in NH for eligible residents. Eversource ConnectedSolutions can provide details on eligibility.6

Funding is limited and capped at $750,000 as of April 2023. There’s an up-front enrollment incentive for purchasing a battery that qualifies under Eversource’s stipulations. Incentives are received after the battery is confirmed and installed.

Demand response participation is mandated for no less than three years. You’re able to get incentive credits for up to 80% of the total discharge capacity of your unit.

Eligible parties receive $230 per kWh, the maximum cap is $3,000. This is sent out via check once batteries are confirmed after installation.

They must be purchased online, between June and September, from three in the afternoon to eight, and there are potential “demand response events”. At these times, your battery may be discharged up to the amount for which you’re enrolled.

This does not apply when inclement weather develops.

Approved battery manufacturers include Sonnen, Generac, and Enphase. If you’re ready to pursue this option, simply email [email protected].

As solar becomes more available, be on the lookout for other localized opportunities like these. They come and go with funding.

Solar Panel Tax Credits in New Hampshire

New Hampshire has no sales tax on solar home systems,1 saving residents money on solar energy acquisition.

Also, no property tax increase follows solar implementation. Net metering, rebates, and financing aren’t really tax-related per se, but do represent a reduction in associated installation burdens, which are a kind of collateral tax.

Beyond these things, NH has federal solar incentives, specifically a tax credit, which will be covered next.

ITC Tax Credit Options

The federal Investment Tax Credit, or ITC, is available for NH residents.

Basically, you cut 30% from implementation costs and subtract that from your annual income taxes.16 If you spent $20k on a solar array in NH, you could claim a $6,000 deduction on federal taxes.

This tax credit has differing implementations for private and commercial applicants. In a commercial atmosphere, PTC, or the Production Tax Credit, acts similarly.25

In that scenario, for every kWh generated, commercial operations receive an inflation-adjusted tax reduction.

If you have minimal to zero tax liability, you may be wondering, “how does the solar tax credit work if I don’t owe taxes?”

Unfortunately, it doesn’t. Since the credit’s purpose is to mitigate the amount you owe in taxes from the government, if you have zero tax to pay, there would be nothing to apply the credit on.

It is also non-refundable, but it can be carried over to the next year and so on to lower the taxes that you may incur in the future.

What Forms Do I Need To Fill Out To Get the Credit?

Claiming the solar tax credit will be easy if you have an installer who will provide all necessary documentation and explain the process for you. But just in case, here are the most important steps you need to follow to apply for the tax credit.

Step 1: Make sure you are eligible.

Before going ahead with the application, you have to see to it that you meet all the qualifications for the solar tax credit. The main requirement for this is that you own the PV system that’s installed in your residence; leased ones won’t be accepted.

The system also needs to be newly installed or used for the first time at the time the credit is being applied on.

Step 2: Download and fill out IRS Form 5695.

To apply for the ITC credit, you’ll need to attach an IRS form 5695 to your regular 1040.10 For the PTC credit, you’ll need to attach an IRS Form 8835 to whatever forms you fill out annually.11

Your CPA, or the tax agency you work through, can help assure you get associated information properly entered into these forms. But the most essential information needed here are the gross cost of the your system and all the related calculations after some rebates.

Step 3: Attach Form 5695 to Form 1040.

You’ll have to enter some of the information you provided on Form 5695 onto the Schedule 3 form. After completing this, gather everything together and file them with your regular tax form 1040.

Is there a deadline for applying for tax credits? Well, since you need to file it with your annual tax return, then the deadline for that applies here as well.

How To Apply for Other Solar Incentives in New Hampshire

To apply for the $200/kW rebate in New Hampshire, you’ll need to contact The New Hampshire Public Utilities Commission.15 They can be reached via telephone at 603) 271-2431, or emailed at [email protected]

You don’t have to make any applications for home equity expansion. If there’s any added from a solar array, assessors won’t factor it in.

The net metering application will depend on the utility company you work with. Each company has its own idiosyncrasies; they may have you fill out varying forms, or send personnel to gauge the efficacy of your array.

Contact your power company and ask them for specifics.

How Much Does It Cost for Solar Power Systems?

Solar costs in NH tend to have an average range that incorporates variables such as the differing costs of panels.12

For a 4 kW system, you’re looking at a low cost of between $10,200 and 12,440, at a price per watt of $2.55 to $3.11.19 On the high end you’re looking at $25,500 to $31,100 for a 10 kW system.

Those expenses are reckoned prior to application for tax credits, rebates, or anything else that might reduce costs.

Expense estimates include panels, cords, surge controllers, power inverters, mounting brackets, transportation, and installation.

If you want to go the DIY route, you can almost cut that in half. Average national costs for a 5 kW array are $5,000 to $7,500;9 that’s $1 to $1.50 per watt and you can have materials shipped to you.

However, if you plan to connect the system to the state energy grid, a certified electrician must perform the work.

Rarely are solar panels free. In fact, there really isn’t a program that gives out solar systems without cost, apart from PPAs or Power Purchase Agreements where a solar energy provider will offer to install the system on your property for free but you’ll still have to buy the electricity generated by the system from them, although at a much lower cost.

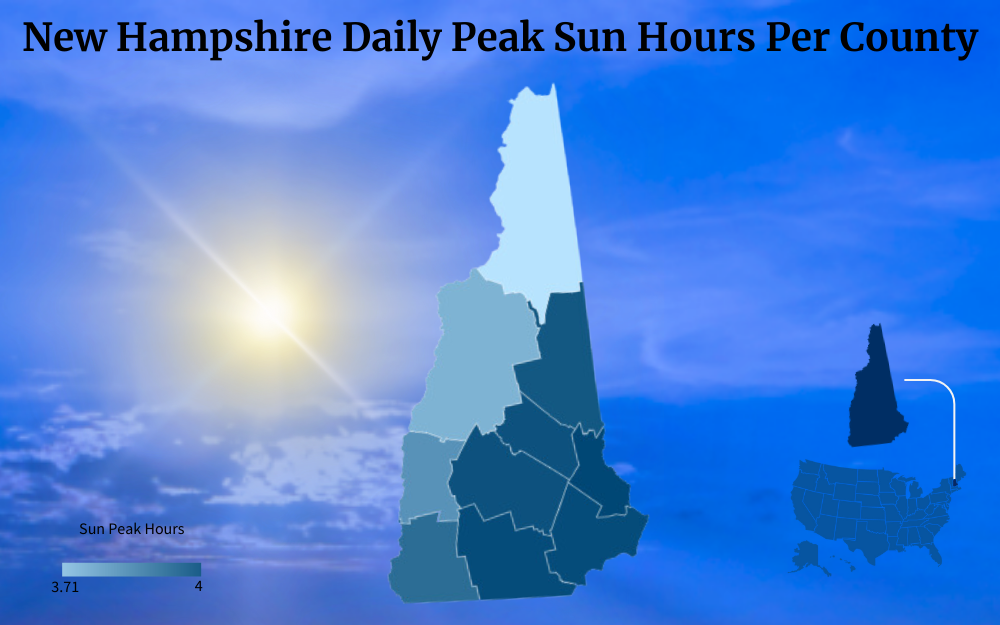

Solar Panel Calculator: Daily Sunlight Requirements and Cost Savings

There are a lot of residential solar power calculators you can find online, but it’s always best to really know the ins and outs of how much you’ll spend and save from having a PV system installed, especially the factors that would affect it.

To determine savings with solar, you’ll need to understand up-front costs and back-end savings.

You’ll want to think about things like installation. A 10 kW system would cover between 500 and 750 square feet.

The variable size of such a system comes from different standards that define available solar panel brands.4 Also, roofing features may affect installation.

Imagine a panel as about 15 square feet or 3 feet by 5 feet. For many brands, 39 inches by 65 inches is a standard 300-watt panel.

There are also 200 watt panels and 100-watt panels, which can help you cover more area. Pricing and exact dimensions vary. A 10 kW array would be 33 panels at 300 watts, and 1 panel at 100 watts.

Most properties won’t need an array that extensive. Still, the size of a large system is a good piece of information to have as a reference point.

When the dust settles, you’re likely making a move akin to an investment, so you want to look at it from every angle. This section will provide you with the variables, then crunch the numbers to give you an average range.

The ITC Credit

Through the ITC credit, you can file for a tax reduction equal to 30% of the total cost of a solar installation. An average 8 kW solar array will cost about $22,640, as that’s the average mean range between $2.55 and $3.11 per installed watts of solar energy.

The ITC credit for that specific array in NH will cut $6,792 from your tax liability in the year you install the solar array if the array costs are $$22,640. If you’ve got a taxable income between $95,376 and $182,100, you pay 24% to the federal government.17

In NH, the average income is between $83,877 and $151,546,26 depending on if an earner is in a single-person or a four-person household. That comes out to an average of $117,711.50.

Accordingly, if you installed a $22,640 solar array, you would only be liable to pay 24% on $111,711.50, for a savings of $1,630.08. Such savings will be higher or lower depending on your income, your tax bracket, and how much you spend on an array.

In some cases, the $6,792 or more you are able to claim will push you into a lower tax bracket, which could seriously increase what you save.

Equity Tax Deferral

Average property taxes in NH are approximately 1.77 percent of total value. The average property value in NH is $451,585.30

So a house worth $451,585 would owe $7,993.05. In this particular instance, the increased tax rate would be $8393.78 without the equity tax deferral, or an added $400.73 a year

To break that down, expect to save about $400.73 a year with an 8 kW array at $22,640. In 10 years, that’s an equity savings of $4,007.30; in 20 years it doubles to $8014.60.

Grid-Based Energy Offset Savings

The average cost of electricity in NH is 30.67 cents per kilowatt. Some estimates put the average at 26.63 cents per kW,18 but it’s often proper to err on the side of caution when budgeting, so here the larger figure is used.

Average NH residents use 935 kW of energy a month.5 It’s best to install a solar array that will generate an average of 935 or more kWs a month through the year

That means you’ll want a system about 8 kWs or higher in size, which is why it has been assumed this is our average NH solar array. With a proper solar array totally offsetting traditional grid-based energy, you could have solar cover a lot of savings; as much as $295.97 a month or $3,551.64 a year.

New Hampshire’s Solar Rebate Program

New Hampshire offers a flat rebate of $200 per kW, meaning up to 5 kWs gives you a savings of $1,000.

For an 8 kW array, you would certainly save $1,000 through this rebate program.

Potential Localized Incentives

Localized incentives will differ per municipality and county, so there’s no average that can be applied in this calculation.

However, if you can find additional local New Hampshire solar incentives, you should factor them into your own cost breakdown for the greatest accuracy in the financial projection of a solar investment.

Net-Metering Potential

The subsequent section explores net metering.

Essentially, your utility companies may pay you for the energy you produce in excess of your usage. An 8 kW array will average 960 kW in an average month, or 25 kWs over your need–just about 1 kW a day

Utility companies in NH will pay 75% to 95% of the value of that kW in net metering benefits. So that’s an average monthly earnings of $5.75 to $7.28 for a usual 8 kW solar array in NH.

Here the average is calculated at $6.51 between those two for an annual net metering earnings of $78.12.

Combining Variables To Determine Savings Potential

Now that all variables are available, it’s time to crunch the numbers:

- Average ITC savings on an 8 kW array at $22,640 will be $1,630.08.

- Annual savings for Equity for average NH residents will be $400.73.

- Totally deferred grid energy savings would put $3,551.64 back in your pocket annually.

- The New Hampshire Rebate Program will save you $1,000 on installation.

- Net metering ought to pay you, on average, $78.12 a year.

In total, for the first year, you have solar energy on your property in NH, residentially, you’d be looking at an up-front cost of $22,640, but that drops to $15,979.43 on average after all New Hampshire solar incentives, discounts, net metering, and tax deferral is applied. So you can save $6,660.57 in your first year with an 8 kW solar array in NH.

This means by the time you defer your utility costs by $15,979.43, you’ve made your money back, and your solar investment starts to actually increase your net worth. So to fully and properly make the calculation, it’s necessary to extend the impact of your choice over time.

In terms of energy savings alone, you’ll earn your investment back in 4.49 years, at an average energy usage cost of $3,551.64 without solar. However, if a system you pay $15,979.43 for adds $22,640 in equity to your property, it’s like you actually earn $6,660.57 in the first year.

After tax breaks and equity expansion, that’s about how much your net worth would see in growth for the first year you install solar system of 8 kW on an average property in NH. After that, in addition to equity, you save $400.73 a year in deferred equity taxes, $3,551.64 in deferred grid energy costs, and earn $78.12 in net metering benefits.

So add approximately $4,030.49 a year to your cost deferral. In ten years, you’ve conserved $40,304.90. In twenty, you’re looking at $80,609.80.

This is basically a non-liquid return on your investment, but if you installed solar and sold your property the following year, what you gain in equity would more than cover what you spent on solar, and then some.

Again, a solar power home calculator will help you determine all of the calculations above faster and more efficiently. So, if you’re pressed for time, just look for one online from reliable sites.

Net Metering Explained

Net Metering is basically a form of PPA or Power Purchase Agreement.23 You can make money by producing more electricity than you use through solar energy.

Residential systems cannot be higher than 100 kW in size,14 commercial systems cannot be larger than 1,000 kWs. You can get 75 to 95 percent of your over-production value back.29

So if you produced 20 kWs over your usage in a month, you would get 15 to 19 kWs worth of credit in return. At 30.67 cents per kW, on average,28 that does add up. Because sunshine shifts through the year, some months are extremely over-productive, and some aren’t.

A 5kWh array can produce up to 20 kWh a day. A 100 kWh array could produce 400 kW. So if you only needed 5 kWh, and you averaged 20, net metering could pay you $3.45 to $4.37 a day.

If you managed to produce 300 kWh over your need at the high end, you might be looking at $69 to $87.40 a day. This means the total residential productive potential for net metering in New Hampshire in the 5 kW to 100 kW range is $3.45 to $87.40 per day.

Sunny days in NH constitute 90 to 199 days a year.2 That means a possibility for between $310.50 and $17,392.60 a year in net metering alone, based on a residential solar array between 5 kW and 100 kW in size.

As noted earlier, you’ll likely average much lower. Still, the potential is there.

Using Photovoltaic Cells in New Hampshire for the Solar Grid

PV, or photovoltaic, solar panels tend to be the primary sort used to generate electricity across the country, and that remains true in NH even if it is one of the states with low solar capacity. These panels are made of cells that convert sunlight to energy.

What do solar cells do? Basically, they absorb photons or light particles that the semiconductor material will turn into electricity.

There are a number of considerations you’ll want to factor in for the installation of such a system. First, know your average electricity needs.

Second, remember that arrays in a day tend to produce about four times what the actual array’s size is.

A 1 kW array produces about 4 kWh a day, on average. That’s a yearly average, expect production to drop in winter.

You’ll want multiple solar batteries for the best results. One solar battery tends to be good for about 24 hours.20

At an average of 90 full days of sunlight per year, 4 full batteries should hold you over for the most part. Solar photovoltaic energy is produced through clouds but at a reduced rate.

Work with installers who can give you the straight data like this guide does. They should be able to itemize each expense and give you a cost projection as well as a savings projection.

Some offer financing directly, sometimes you can get financing through the government and use that to pay the solar installation experts. One thing you don’t want to do is just pick an installer and go for it.

Read online reviews, question companies that have worked with solar installers, and interview residential clients of solar.

It’s also a good idea to find solar users who have had solar power installed for longer than a year. The longer they’ve had it installed, the better an idea you can get of the quality a given solar installation expert may provide.

Also, ask around users for advice on how to test solar panels so you’ll be able to determine immediately if there’s a problem in your new system.

High-grade solar systems, of course, largely depend on the manufacturer. So, it’s not a surprise that many people ask where are solar panels made.

Materials that make up the whole system come from different areas around the globe, so you just have to do your research and look for testimonials about the manufacturer once you’ve settled on your solar panels of choice.

Other Facts You Need To Know Before Going Solar

There are virtually no cons or problems with solar energy other than the fact that since it relies on sunlight to produce electricity, you’ll need to have abundant sunshine to make it work to its full capacity.

However, there are still a few things you need to learn or be aware of when deciding to go solar. For example, does solar energy cause pollution?

While in operation, solar panels do not emit any harmful gases into the atmosphere, unlike other typical sources of energy. But you’ll have to be wary of what to do with it once it reaches its end of life.

How often do solar panels need to be replaced depends on the quality of the system and its maintenance over the years, but on average, its lifetime is around 25-30 years. Once it reaches the point where it’s not able to perform its function anymore, you’ll have to explore options to have it recycled by authorized entities or properly disposed of as hazardous waste.

New Hampshire is one of the best states to acquire solar energy for a number of reasons, not least of which is the cost of traditional grid-based energy.

Because of that high cost, if you get an average array and acquire all associated incentives, you will see your net worth increase in the year that you install despite acquisition costs.

From there, you’ll be offsetting $4,000 or more in expenses annually.

When you crunch the numbers, New Hampshire solar incentives are quite worthwhile for reducing the cost of solar panels in the state and making the home solar energy switch more affordable.

Frequently Asked Questions About New Hampshire Solar Incentives

How Large Should My NH Solar Array Be?

Average NH homes should have a solar array that’s about 8 kW in size, or 8,000 watts, which would be eighty 100-watt panels, or sixteen 500-watt panels. Assume 8 square feet per 100 watts,21 so that’s about 640 square feet, or a room that’s between 25 and 26 feet on a side; and while most roofs are large enough to accommodate this, sometimes you’ll need to install arrays atop adjustable mounts on the ground.

Do Solar Tax Credits Work in NH if I Don't Owe Taxes?

Only those who owe the federal government income tax can benefit from the ITC tax credit. However, if you own your home without any sort of mortgage, and your solar PV panels add average equity, you can expect $400 or more a year in deferred property taxes.

How Many NH Residents Have Made the Solar Transition?

With an average of 2.46 residents per home and over 29,500 households utilizing solar, there are approximately 72,570 persons who rely on solar energy in New Hampshire.

References

1Bopray, A., & Novak, L. (2023, September 6). New Hampshire Solar Incentives: Tax Credits and Rebates Guide (2023). Today’s Homeowner with Danny Lipford. Retrieved September 11, 2023, from <https://todayshomeowner.com/solar/guides/new-hampshire-solar-incentives/>

2Current Results Publishing Ltd. (2023). Amount of Sunshine New Hampshire Gets Each Month. Current Results. Retrieved September 11, 2023, from <https://www.currentresults.com/Weather/New-Hampshire/sunshine-by-month.php>

3Daly, L. (2022, December 18). Which States Produce the Most Renewable Energy? The Motley Fool. Retrieved September 11, 2023, from <https://www.fool.com/research/renewable-energy-by-state/>

4De Socio, M. (2023, April 5). How Big Are Solar Panels? Here’s Their Typical Size and Weight. CNET. Retrieved September 11, 2023, from <https://www.cnet.com/home/energy-and-utilities/solar-panel-size/>

5EnergySage. (2023). Cost of electricity in New Hampshire. EnergySage. Retrieved September 11, 2023, from <https://www.energysage.com/local-data/electricity-cost/nh/>

6Eversource. (2023). Residential. Eversource. Retrieved September 11, 2023, from <https://www.eversource.com/content/residential/save-money-energy/energy-efficiency-programs/demand-response/battery-storage-demand-response>

7The General Court of New Hampshire. (2023). TITLE V TAXATION. The General Court of New Hampshire. Retrieved September 11, 2023, from <https://www.gencourt.state.nh.us/rsa/html/V/72/72-61.htm>

8Glover, E., & Allen, S. (2023, February 24). The Best And Worst States For Solar Energy 2023. Forbes. Retrieved September 11, 2023, from <https://www.forbes.com/home-improvement/solar/best-worst-states-solar/>

9Hyder, Z. (2023, January 12). DIY solar panels: Pros, cons & 6-step cost savings guide. SolarReviews. Retrieved September 11, 2023, from <https://www.solarreviews.com/blog/pros-and-cons-of-buying-diy-solar-panels>

10Internal Revenue Service. (2022). Form 5695. Retrieved September 11, 2023, from <https://www.irs.gov/pub/irs-pdf/f5695.pdf>

11Internal Revenue Service. (2023, April 14). About Form 8835, Renewable Electricity Production Credit. Internal Revenue Service. Retrieved September 11, 2023, from <https://www.irs.gov/forms-pubs/about-form-8835>

12Neumeister, K., & Smith, M. (2023, September 4). How Much Do Solar Panels Cost in New Hampshire? (2023 Savings Guide). EcoWatch. Retrieved September 11, 2023, from <https://www.ecowatch.com/solar/panel-cost/nh>

13New Hampshire Department of Energy. (2023). Renewable Energy. New Hampshire Department of Energy. Retrieved September 11, 2023, from <https://www.energy.nh.gov/renewable-energy>

14New Hampshire Government. (2023). Net Metering. New Hampshire Public Utilities Commission. Retrieved September 11, 2023, from <https://www.puc.nh.gov/sustainable%20energy/Net%20Metering/Net_Metering.html>

15New Hampshire Government. (2023). New Hampshire Public Utilities Commission. New Hampshire Public Utilities Commission. Retrieved September 11, 2023, from <https://www.puc.nh.gov>

16North Carolina Clean Energy Technology Center. (2023, August 29). Business Energy Investment Tax Credit (ITC). DSIRE. Retrieved September 11, 2023, from <https://programs.dsireusa.org/system/program/detail/658>

17Parys, S., & Orem, T. (2023, August 2). 2022-2023 Tax Brackets and Federal Income Tax Rates. Nerdwallet. Retrieved September 11, 2023, from <https://www.nerdwallet.com/article/taxes/federal-income-tax-brackets>

18Reese, N. (2023, August 8). Electricity Rates in New Hampshire. Find Energy. Retrieved September 11, 2023, from <https://findenergy.com/nh/>

19SolarReviews. (2023, September). How much do solar panels cost in New Hampshire, 2023? SolarReviews. Retrieved September 11, 2023, from <https://www.solarreviews.com/solar-panel-cost/new-hampshire>

20SolarUnion. (2023, April 16). How Long Can a Solar Battery Power a House? Solar Union. Retrieved September 11, 2023, from <https://www.solarunion.com/blogs/2023/april/how-long-can-a-solar-battery-power-a-house-/>

21Thoubboron, K. (2019, March 18). 100-watt solar panels: are they enough for you? EnergySage. Retrieved September 11, 2023, from <https://news.energysage.com/100-watt-solar-panels-are-they-enough-for-you/>

22United States Census Bureau. (2022). QuickFacts New Hampshire. U.S. Census Bureau. Retrieved September 11, 2023, from <https://www.census.gov/quickfacts/NH>

23U.S. Department of Energy. (2023). Power Purchase Agreement. Better Buildings. Retrieved September 11, 2023, from <https://betterbuildingssolutioncenter.energy.gov/financing-navigator/option/power-purchase-agreement>

24U.S. Department of Energy. (2023). Property Assessed Clean Energy Programs. Office of State and Community Energy Programs. Retrieved September 11, 2023, from <https://www.energy.gov/scep/slsc/property-assessed-clean-energy-programs>

25U.S. Department of Energy. (2023, August). Federal Solar Tax Credits for Businesses. Office of Energy Efficiency & Renewable Energy. Retrieved September 11, 2023, from <https://www.energy.gov/eere/solar/federal-solar-tax-credits-businesses>

26U.S. Department of Justice. (2023). Census Bureau Median Family Income By Family Size. U.S. Department of Justice. Retrieved September 11, 2023, from <https://www.justice.gov/ust/eo/bapcpa/20230401/bci_data/median_income_table.htm>

27U.S. Energy Information Administration. (2021). 2021 Average Monthly Bill- Residential. U.S. Energy Information Administration. Retrieved September 11, 2023, from <https://www.eia.gov/electricity/sales_revenue_price/pdf/table5_a.pdf>

28Warren, T. (2023, September 11). Compare New Hampshire electricity rates. Energybot. Retrieved September 11, 2023, from <https://www.energybot.com/electricity-rates/new-hampshire/>

29Zientara, B. (2023, June 1). Guide to net metering in New Hampshire for 2023. SolarReviews. Retrieved September 11, 2023, from <https://www.solarreviews.com/blog/new-hampshire-net-metering>

30Zillow. (2023). New Hampshire Home Values $451,585. Zillow. Retrieved September 11, 2023, from <https://www.zillow.com/home-values/39/nh/>

31Screenshot of IRS Form 5695. Internal Revenue Service. Retrieved from <https://www.irs.gov/pub/irs-pdf/f5695.pdf>

32Screenshot of PA-29. New Hampshire Department of Revenue Administration. Retrieved from <https://www.revenue.nh.gov/forms/2022/documents/pa-29-2022-print.pdf>